The Obama administration and other supporters believe that not enough borrowers are taking advantage of Income Based Repayment (IBR), a student loan forgiveness program. However, since it is higher-income college graduates who “ultimately end up benefiting overwhelmingly from IBR”, I’m not sure this is a problem.

IBR reduces loan payments based on a percentage of income, subsidizes interest charges, and forgives loan balances after 25, 20, or 10 years. It sounds like a nice deal. However, knowledge of the IBR “remains a largely obscure concept for many cash-strapped college graduates”. It is estimated that only about one-half of qualified borrowers are taking advantage of this free money.

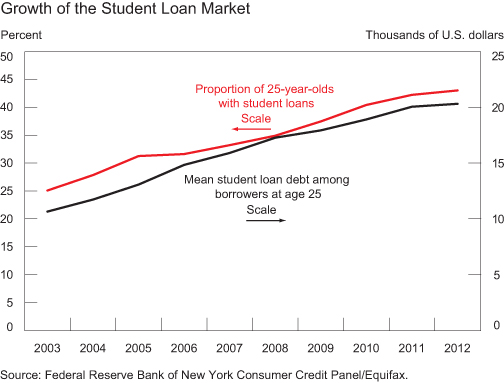

… according to DOE data as recent as January, a little more than 2.3 million borrowers had applied for IBR nationally, a small fraction of the estimated 38 million Americans with outstanding student loan debt…

Such low figures have shone a glaring spotlight on the DOE’s failure to sufficiently educate borrowers, according to consumer advocates like Mark Kantrowitz, the publisher of FinAid.org and FastWeb.com, who estimates that as many as 3 million students could qualify.

Hypothetical examples generated by using the New America Income-Based Repayment Calculator show how forgiven loan amounts can reach into the six figures. (All numbers are approximate.)

Loan amount: $70,000 combined undergraduate and graduate

Income: $40,000 initially with 2.5% annual increase

Without IBR: $550-600 monthly loan payments with total repayment cost of $165,000 including principal and interest

With Old IBR: $300 monthly loan payments with total repayment cost of $98,000 including principal and interest — Savings = $65,000

With New IBR: $160-170 monthly loan payments with total repayment cost of $49,000 including principal and interest — Savings = $115,000

Old IBR applies to initial loans dated on or before October 1, 2007, while the more generous New IBR applies to loans after that date.

The millions of borrowers who qualify but do not participate are “effectively leaving a rather sizable amount of money on the table”. Some of the most generous IBR benefits go to graduates who take jobs in non-profit or government sectors because their loans are forgiven after only ten years. Jason Delisle, director of the Federal Education Budget Project at the New America Foundation, advises college graduates to take advantage of this benefit.

“If you plan on doing any kind of public service, nonprofit or government work,” said Delisle, “then you should borrow as much money as [your school] will possibly let you.”

Under the New IBR, a student who owes $70,000 upon graduation would end up paying back only $22,000 if he stayed ten years at a government job with a starting salary of $40,000. That’s a savings of $143,000 compared to how much that graduate would have paid had he not taken the IBR option.

Indeed, the IBR savings that accrue to borrowers who pursue such career paths can be mind-boggling.

IBR produces “far more benefits” to higher-earning graduates.

But it’s not only those who work in public service professions who benefit disproportionately from IBR, according to Delisle. “The program provides far more benefits to those at the higher end of the income spectrum,” he noted, such as doctors, lawyers and those with MBAs.

“While the program provides very large subsidies when your income is low,” he said, “it really doesn’t claw those benefits back if your income ends up being high,” meaning graduates with large sums in student loan debt—ordinarily graduates of medical, law and business schools, who typically make higher starting salaries—ultimately end up benefiting overwhelmingly from IBR.

So a student who graduates from Harvard Law School with $150,000 in student loans and goes to work at a law firm making close to six-figures annually still stands to receive a “windfall”—as Delisle calls it—of six-figures in principal and interest forgiven on average.

IBR cheerleader says everyone should borrow for college because the taxpayers “pick up any downside risk or loss”.

Because of IBR there’s “no reason not to pursue a graduate degree and borrow to pay for it,” said Delisle.

“There’s only upside, because the government is stepping in to pick up any downside risk or loss,” he said. “It’s mind-blowing how generous income-based repayment really is.”

Sounds like a lousy program to me, speaking as a taxpayer.

Related: Income Based Repayment (IBR) is a ‘moral hazard’ for high-income student loan borrowers (Cost of College)