Joe Trippi, a longtime Democratic political strategist. has been a proponent of school choice ever since he was a kindergartener and his mother fought to allow him to attend a safer school outside his neighborhood.

Trippi was recently interviewed by Reason.tv at a National School Choice Week event.

“… The status quo is not working. Let’s put everybody’s ideas on the table. If you’re in support of current public school system the way it is let’s talk about it, but I don’t think it’s working….

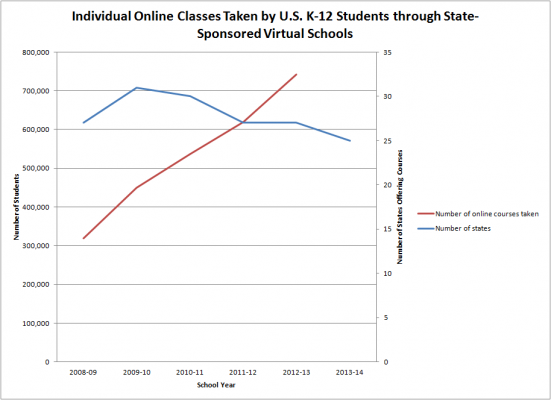

The reason for School Choice Week is because technology is moving so fast that most government bureaucracies can’t keep up with it. One of them is education….

We have 500 cable channels and a one-size-fits all school system.”

Not having school choice has “been wrong for 50 years”.

“… we have more choice at a 7-Eleven them in the way we educate our children. That’s crazy….”

School choice is becoming more of a bipartisan movement.

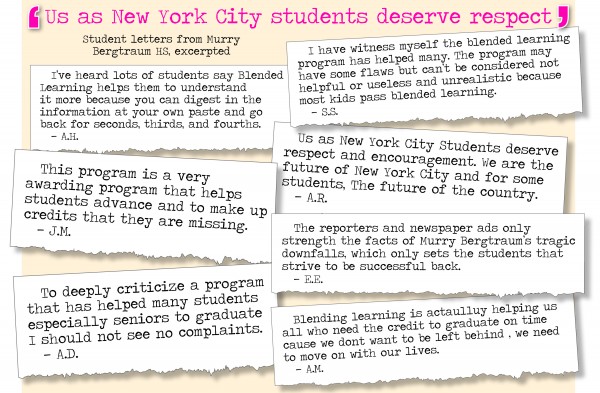

Democrats and school choice have a long, tangled relationship. Few know better than Trippi. He’s been deep inside Democratic politics since the 1970s, and his firm, Trippi & Associates, has advised National School Choice Week since its inception in 2010. So what’s he seeing on the ground now? A lot of Democrats coming around on school choice, especially at the local level, especially in inner cities.

Along with the trend of increased support for school choice, Trippi sees a libertarian president in the near future.

… Four important changes in American politics are creating this opportunity: a socially tolerant public, the effective end of the two-party system, disruptive technologies, and the growing popularity of politicians such as Sen. Rand Paul (R-Ky.).

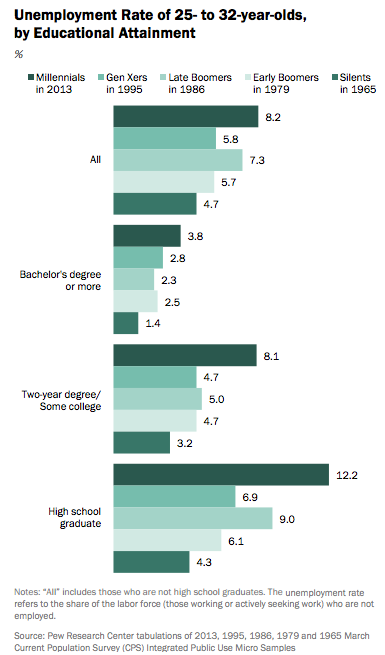

“The younger generation is probably the most libertarian and sort of tolerant, and has more libertarian values, I’d say, than any generation in American history” …

Related: