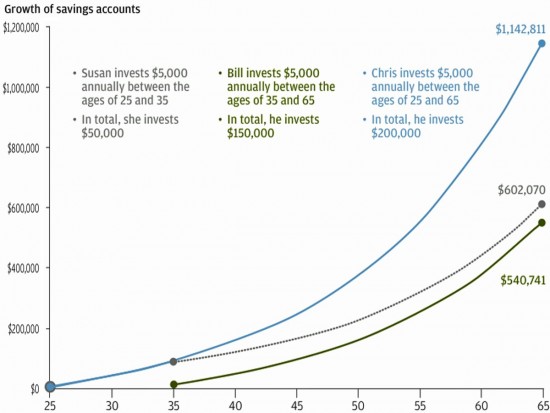

The power of compounding is a reason to start saving for retirement as early as possible.

J.P. Morgan offers an illustration of “the importance of saving sooner than later”.

Their example consists of three people who experience the same annual return on their retirement funds:

- Susan, who invests $5,000 per year only from ages 25 to 35 (10 years)

- Bill, who also invests $5,000 per year, but from ages 35 to 65 (30 years)

- And Chris, who also invests $5,000 per year, but from ages 25 to 65 (40 years)

Intuitively, it makes sense that Chris would end up with the most money. But the amount he has saved is astronomically largely than the amounts saved by Susan or Bill.

Interestingly, Susan, who saved for just 10 years, has more wealth than Bill, who saved for 30 years.

That discrepancy is explained by compound interest.

You see, all of the investment returns that Susan earned in her 10 years of saving is snowballing — big time. It’s to the point that Bill can’t catch up, even if he saves for an additional 20 years.

…

Saving for just 10 years now works out better than saving for 30 years later.

Saving “$5,000 per year only from ages 25 to 35 (10 years)” will generate a larger retirement nest egg than saving “$5,000 per year, but from ages 35 to 65 (30 years)”.

It’s often hard for 20-somethings to save.

Many young college graduates are unable to start saving in their twenties because they are pursuing graduate degrees. Others may be woefully underemployed or working in low-paying internships, understandable in light of the fact that we are experiencing worst unemployment rates for college graduates in 50 years. Some are struggling to support families. Other 20-somethings may simply be squandering their paychecks by living the high life of frequent traveling and expensive dinners with friends.

ADDED: Burdensome student loan payments prevent many recent college graduates from putting money away for retirement.

Business Insider recommends that “Every 25-Year-Old In America Should See This Chart”. Considering that decisions about how they will be spending their twenties are often made at a younger age, I think every 18-year old in America should also see this chart. Realistically though, all this is much more clear in hindsight.

Sam Ro, “Every 25-Year-Old In America Should See This Chart”, Business Insider, Mar 21, 2014.

Related: A quick way to calculate how much you’ll need for retirement (Cost of College)