December 9, 2015

by Grace

Lynn O’Shaughnessy reports on a change that will make filing FAFSA easier.

Currently, the earliest that families can file FAFSA each year is January 1, and college deadlines for this information can be as early as February. At the same time, prior year tax return information must be included in the submission, making it difficult for parents who have not filed their taxes as of February.

The parental scramble to file the FAFSA and get their taxes completed will soon no longer be an issue. Beginning with the 2017-2018 school year, students will be using prior-prior tax returns when completing the FAFSA.

Parents of students who will be in college in the fall of 2017, for example, will use their 2015 federal tax return to complete the FAFSA. Under the traditional system, these parents would have relied on their 2016 tax returns. So you can see that scrambling to complete their tax returns will no longer be an issue because of the reliance on an older tax return.

One of the most critical points families must consider in light of these change is that their 2015 financial situation will be used twice in determining eligibility for financial aid. This can penalize families who has an unusually prosperous 2015.

Taxes for 2015 will be doubly important.

As the system transitions to using prior-prior returns, many families will have to use their 2015 tax return twice. Parents will use the 2015 return if they are applying for aid for the 2016-2017 school year and the following year too.

Relying on the 2015 tax return twice won’t be an issue for parents whose incomes have remained stable during those two years. But it can be a terrible development for families who experienced a tremendous financial year in 2015 but not in 2016.

What should these families do?

If your financial situation has changed since you filed your 2015 tax return, you can ask for a professional judgment from a school. College financial aid administrators have the power to adjust your aid amount based on information that isn’t reflected in the aid application.

Check out this link for more details on upcoming FAFSA changes:

Posted in back to basics, before college, cutting college costs -- ideas for students, financial aid, need-based aid |

Comments Off on Prepare for upcoming FAFSA changes

May 29, 2015

by Grace

Gap years have become more populare in the U.S.

… Prominent in Europe since the 1960s, the intentional and structured break from formal education before college is becoming increasingly popular in the U.S.

Formally described as a time for “increasing self-awareness, learning about different cultural perspectives, and experimenting with future possible careers”, in many cases a gap year’s most important benefit is simply to help a young person mature and be able to make better decisions about college plans.

While some gap programs cost about as much as a year of college, many other options are more affordable. Sometimes a gap year is a time to earn extra money for college. Simply living at home while working is a basic option, perhaps with classes or travel included for personal growth and preparation for college. Other low-cost options include domestic or international travel along with internships.

Proper planning maximizes opportunities.

Before you design your gap year plan, sit down and really think about what interests you want to explore or what countries spark your interest. Combining an interest (such as learning Spanish) with a low-cost opportunity (such as Au Pairing in Spain) ensures your gap year will be meaningful to you as well as cost-effective.

WWOOF and Help Ex are two resources for matching students with farms, homestays, ranches, lodges, B&Bs, backpackers hostels and other options where volunteers receive room and board in exchange for work. Dynamy’s program of mentored internships has been personally recommended in one situation I know.

Families are becoming more receptive to gap years, and many believe that it is a good way to lower the chances of college students wasting time and money in college while they try to figure things out.

———

Naila Francis, “Gap years gain popularity as students seek purpose, passion”, The Intelligencer, July 13, 2014.

Julia Rogers, “An Affordable Gap Year”, My College Planning Team, November 6, 2014.

Posted in back to basics, before college, cutting college costs -- ideas for students, trends |

Comments Off on Is a gap year right for your child?

May 20, 2015

by Grace

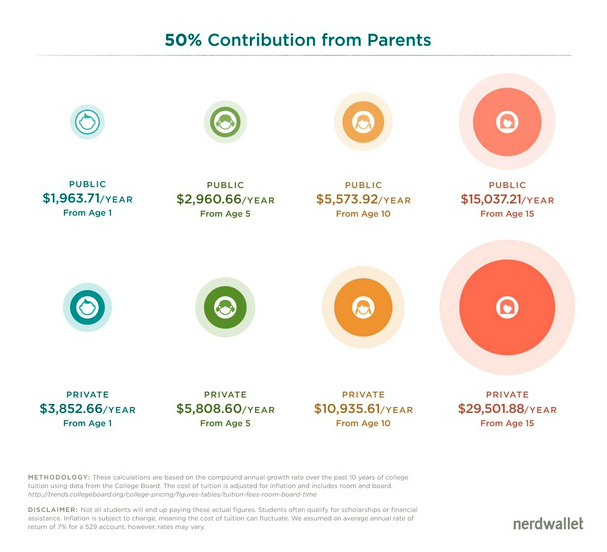

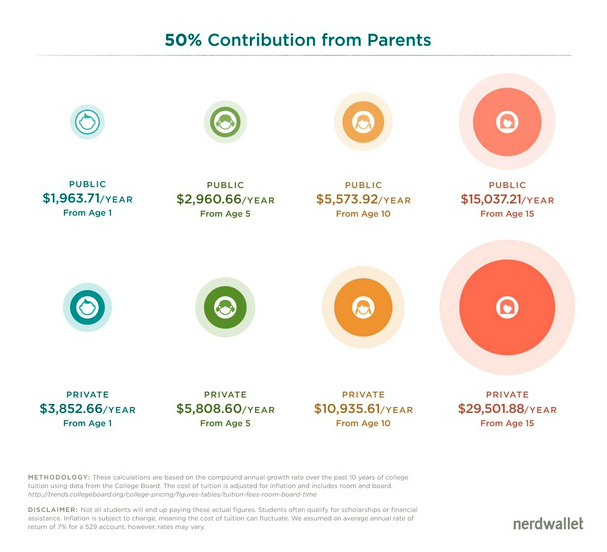

How much do you need to save each year to pay for your child’s college?

NerdWallet calculated the amounts based on average costs of college and expected increase in annual costs.

Do you want to fund 50% of your child’s college costs? If your child is ten years old, then you’ll have to save almost $6,000 a year to pay half his costs to attend an in-state school.

If you’d like to fine tune your calculations, try using the World’s Simplest College Cost Calculator from SavingForCollege.

Posted in back to basics, paying for college, saving for college |

Comments Off on How much to save each year for college

May 8, 2015

by Grace

For high school seniors, it can be comforting to be able to secure admission to a good school early on in application season. It reduces the stress during the months of applying and waiting for decisions from other colleges. For this reason, high-achieving students should consider applying to “High-Ranking Schools With Rolling Admissions”.

- Pennsylvania State University—University Park

- University of Pittsburgh

- Purdue University—West Lafayette (IN)

- Rutgers, The State University of New Jersey—New Brunswick

- University of Minnesota—Twin Cities

- SUNY College of Environmental Science and Forestry

- Indiana University—Bloomington

- Michigan State University

- University of Tulsa (OK)

- University of Alabama

- Stony Brook University—SUNY

- Binghamton University—SUNY

Rolling admissions are often offered by large state universities. Students can apply in the fall, sometimes as early as September, and receive word within a few weeks.

———

Delece Smith-Barrow, “High-Ranking Schools With Rolling Admissions”, U.S. News & World Report, Nov. 6, 2014.

Posted in applying to college, back to basics, college search and selection, colleges |

5 Comments »

May 6, 2015

by Grace

The New York Times ran an article in which student loan borrowers explained what they wish they had known before taking on debt.

Federal law makes debt counseling mandatory for first-time borrowers, but “because the topic is dense and the department’s content is devoid of anecdotes, it’s tough to make the lessons stick”. Most colleges use the Department of Education’s online counseling module, which apparently most students find difficult to navigate and comprehend. What type of counseling would work to make students clearly realize what they were getting themselves into before it was too late?

The ideas from the article seem helpful, but some of them, like requiring a course during the first year of college, are only applicable after the money has been borrowed. Plus that recommendation seems to be overkill and costly.

A TG report, “A Time to Every Purpose“, gives some other suggestions for colleges, including these:

- Delivering supplemental counseling, ideally in a face-to-face setting, in order to help answer questions

- Providing sample budget sheets using local cost-of-living expenses

Ultimately, it is the student’s responsibility to take the time to fully understand the implications of college debt. Maybe students who borrow should have to pass a pre-entrance exam that covers practical knowledge about how loans will affect their personal financial situation.

Related: “College students are ignorant about how student loans work”

———

Ron Leiber, “Student Loan Facts They Wish They Had Known”, New York Times, May 1, 2015.

Posted in back to basics, before college, financial aid, personal finance, student loans |

Comments Off on It’s hard to make students understand the severity of college debt

April 21, 2015

by Grace

Among its “tips for deciphering financial-aid letters”, the Wall Street Journal includes information that can be useful in evaluating student loan offers.

Difference between subsidized and unsubsidized federal student loans

The federal government pays interest charges on federally subsidized loans while a student is in school, for example, which can help borrowers substantially. Such loans are generally given to students who demonstrate some kind of financial need, but students don’t need to come from low-income families to qualify.

Just over 34% of undergraduates with family income of at least $100,000 received subsidized Stafford loans at colleges where total annual costs, including tuition and room and board, were at least $30,000 in 2011-12, according to an analysis by Edvisors of the most recent federal data available. Just 12% of such students received the loans when attending less-expensive colleges.

Unsubsidized federal loans can be less desirable because interest accrues while the student is in school, which—if unpaid—could result in a significantly larger balance by the time the student graduates. Some colleges don’t include unsubsidized loans in financial-aid offers.

Colleges and universities also may offer their own loans, which may or not be preferable. Compare and contrast the terms on offer, including the interest rate and when interest charges begin to boost the outstanding balance.

Check out this link for the full article:

Posted in back to basics, college search and selection, cutting college costs -- ideas for students, financial aid, paying for college, student loans |

Comments Off on Evaluating college financial aid award letters

April 20, 2015

by Grace

While a 529 plan is commonly considered the “best college savings vehicle”, this option does have some downsides.

Reasons to use a 529 plan:

Investments in 529 plans grow tax-deferred and withdrawals are tax-free when used for qualified college expenses. Also, most states offer income tax deductions on contributions. Even if funds are not needed for the intended beneficiary, there are other options that let the owner escape tax penalties.

Reasons against using a 529 plan:

• The earnings portion of withdrawals not used for qualified expenses is subject to ordinary income taxes and a 10% penalty.

• It’s not for the short term.

… one instance where the benefits of a 529 college-savings plan may not have time to accrue is for those that are looking at very short investment horizons—such as one year—before beginning to take withdrawals. The benefit of tax-free growth is very limited over such a short period of time in low-return, no-risk investments, and could be offset by investment expenses or plan fees in the short run.

• Requires extra research.

Plans will vary from state to state, which is a little more challenging for families. Therefore, you need to do your due diligence on the sales charges, fees, and investment choices by the plan administrator.

• Limited investment options and higher fees.

• Restrictions in moving funds between accounts.

Some families may simply prefer to maintain more flexibility and control over their college savings, and therefore are willing to forego the tax benefits that 529 plans offer. There are no absolute right or wrong choices since investing is a highly personalized undertaking. Here’s a good resource for learning more about 529 plans:

Understanding 529 Plans

———

“The Experts: Are 529 Plans the Right Choice for All Families Saving to Send Their Kids to College?”, Wall Street Journal, June 5, 2013.

Posted in back to basics, cutting college costs -- ideas for students, saving for college |

Comments Off on Pros and cons of 529 plans

April 14, 2015

by Grace

Don’t wait until your child’s senior year of high school to begin planning how to pay for college. The first 18 years go quickly, and it’s never too soon to begin preparing.

Here’s one simplified approach showing some important steps along the timeline to college, with a focus on the financial planning aspect of the process.

Before High School

Start saving for college ASAP: This is the relatively uncomplicated part. Although we can’t predict the costs of college over a child’s lifetime, it almost always makes sense to begin saving early on. Even if MOOCs or other innovations make higher education more affordable in the future, there’s usually not much of a risk in saving too much since there are options for dealing with “left-over money in your 529 plan”.

Before Junior Year of High School

- NMS potential: If your child tends to score in the 95%ile of standardized tests, he may have a shot at earning a National Merit Scholarship. A little test prep can make the difference in qualifying for significant merit financial aid.

- Base Income Year (BIY): If there is a chance your family may qualify for need-based financial aid, you should explore ways to minimize income during the BIY, the 12-month period that begins January 1 during your child’s junior year. Since the BIY is used as a snapshot for determining financial need, you may want to consider strategies such as not selling stocks or property that will create large capital gains, refrain from converting to a Roth IRA, or defer bonus or other income.

Junior Year of High School

- Create list of schools: Get serious and make a realistic list that includes academic and financial safeties.

- Can we afford it? 1-2-3: Determine affordability by using the 1-2-3 Method or something similar.

Senior Year of High School

Senior year is the busiest time for families as they handle the many details of the college application process, including final determination of how they will be paying. Some important acronyms:

The two main forms used in determining financial aid eligibility are the FAFSA and PROFILE.

FAFSA is the acronym for Free Application for Federal Financial Aid. It is a form submitted to the government that collects the financial information needed to decide your eligibility for federal FA. It’s also used by many colleges to determine institutional aid.

PROFILE is a financial aid application service offered by the College Board, used by about 400 colleges to learn if students qualify for non-federal student aid. There is a fee to submit a PROFILE, whereby the FAFSA is free.

The SAR (Student Aid Report) is a summary of your FAFSA responses and provides “some basic information about your eligibility for federal student aid”.

It’s important to get started.

While this outline only hits the highlights along the road to paying for college, it can be used as a springboard for further research and action. It makes sense to start with an outline, and then fill in the details as you go along.

Posted in back to basics, before college, college search and selection, cutting college costs -- ideas for students, financial aid, paying for college, personal finance, practical info |

4 Comments »

April 13, 2015

by Grace

While most colleges that use the CSS/Financial Aid PROFILE do include the value of your home in calculating eligibility for financial aid, there are some exceptions.

PROFILE Schools That Ignore Home Equity*

- Bard College

- Bucknell University

- California Institute of Technology

- DePauw University

- Hamilton College

- Harvard University

- Princeton University

- Santa Clara University

- University of Virginia

- Washington University, St. Louis

- Whitman College

*This list was compiled last year, and changes may have occurred since then.

Additional information about how other PROFILE schools treat home equity can be found by clicking the link above.

Summary:

- Schools that only use the FAFSA (Free Application for Federal Student Aid) to determine eligibility for financial aid do not use home equity in the calculation.

- Schools that use the CSS/Financial Aid PROFILE to determine eligibility usually use home equity in the calculation, but often the amount is capped as a percentage of a family’s income.

Running the Net Price Price calculator for a particular college will usually show if home equity is counted, but the best way to be sure is to ask the school.

Schools can be flexible in awarding financial aid, and Lynn O’Shaughnessy reminds us of this important point:

By the way, how schools treat home equity can also depend on how desirable an applicant is.

———

Lynn O’Shaughnessy, “Will Your Home Equity Hurt Financial Aid Chances?”, The College Solution, August 7, 2014.

Posted in back to basics, cutting college costs -- ideas for students, financial aid, need-based aid |

Comments Off on Only some colleges count home equity in financial aid calculations

April 8, 2015

by Grace

College financial aid letters have just been sent, and you may want to think about how to negotiate for more money.

Many families don’t realize it, but there is often a little wiggle room in financial aid awards. FAFSA, the form the government and colleges use to determine need- and some merit-based aid, doesn’t capture all circumstances that might affect a family’s ability to pay for school. For instance, there’s no line to include the cost of caring for an elderly parent or special needs child, the kind of expenses that could warrant more aid, said Mark Kantrowitz, publisher of Edvisors.com, a college planning Web site. So if you weren’t able to share that kind of information with the school, now is the time to bring it up to see if that shakes free some more assistance.

You can request a professional judgement review.

If you do decide to negotiate, you can appeal to the school’s financial aid administrator for what’s known as a professional judgment review. Gather up every piece of documentation of any changes to your family finances or special circumstances that could impact your ability to pay for school. If the financial impact is significant enough, the school may adjust your child’s award.

Don’t attempt to haggle.

“Colleges are not car dealerships, where bluff and bluster can get you a better deal. Very few colleges will make a revised financial aid offer when a student gets a more generous financial aid offer from a competitor,” he said.

But some schools, like Cornell and Carnegie Mellon, will consider matching offers of peer institutions.

You “should be careful in the language and manner” of your approach.

“We won’t ‘negotiate,’ but we might ‘review.”

Looking for more tips? “Want to appeal your college financial aid? Go for it”

———

Danielle Douglas-Gabriel, “How to negotiate a better financial aid package”, Washington Post, April 2, 2015.

Posted in applying to college, back to basics, cutting college costs -- ideas for students, financial aid, paying for college |

Comments Off on How to ask for more college financial aid