Why did President Obama do such a quick about-face on 529 plans, first proposing to eliminate them and then a few days later dropping that proposal? Although it was widely believed that this initiative had zero chance of getting through Congress, it appears Obama’s actions were due to the efforts of the elusive “middle class”.

Several news sources have pointed out how poorly this proposal polled, notably with Democratic voters. It seems the administration could have predicted this reaction, but apparently they were blindsided. Obama’s proposal would have penalized wealthy families the most, since 70% of 529 “tax benefits go to households earning more than $200,000”. As such, “middle class” families would not be seriously hurt by this change. But here’s the rub. The vast majority of Americans consider themselves middle class, including many with household incomes well into the six-figure range.

Don’t tax me, tax that rich guy over there.

The first rule of modern tax policy is raise taxes only on the rich. The second rule is that your family isn’t rich, even if you make a lot of money.

President Obama’s State of the Union proposal to end the tax benefits for college savings accounts ran afoul of these rules, which is why he abandoned it, under intense pressure from both political parties, within a week.

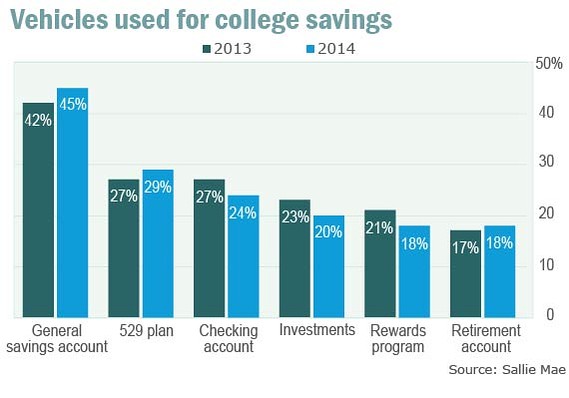

Tax-free college savings accounts, like the mortgage interest deduction and the state and local tax deduction, principally benefit people who range from affluent to wealthy. In pushing its proposal, the White House pointed to Federal Reserve data showing that 70 percent of balances in the college accounts were held by families making at least $200,000 a year. In theory, tax reform is supposed to be built around cutting back preferences like these, in order to pay for some combination of lower tax rates and tax preferences aimed at people with lower incomes.

Politicians have met with strong resistance to increasing taxes on the “merely affluent”.

But in practice, politicians from both parties have made a point of holding the group you might call the “merely affluent” harmless from tax increases. If you make $150,000 to $225,000, you make about two to three times the national median income for a married couple. The list of occupations that can get you into this income bracket — government official, academic, lobbyist, journalist — can sometimes make it hard for people in political circles to remember that 92 percent of American married couples make less than $200,000 a year.

A lot of people in this category don’t think of themselves as rich, and they benefit from tax provisions like college savings accounts.

So how can politicians raise more tax revenue? It’s a challenge.

… If you can’t go after tax provisions for the merely affluent, you are exempting almost everyone from tax increases. And if you can’t broaden the tax base, then you are very limited in how much you can finance tax reform.

Where else can they find the money?

Raising taxes on the very rich won’t raise enough revenue to balance the budget, and the bottom 50% of income earners — who only pay about 2% of all federal taxes — are not a likely source.

Peter Suderman of Reason believes the 529 debacle shows that the “existing welfare state is unaffordable”. On the other hand, Reihan Salam of Slate laments that the upper middle class is ruining all that is great about America. In essence, both may be saying the same thing. It’s hard to finance expansive government programs because “eventually you run out of other people’s money”.

———

Josh Barro, “A ‘Rich’ Person Is Someone Who Makes 50 Percent More Than You”, New York Times, January 29, 2015.